Export Documentation and processes

In this post, a basic idea about export procedures and formalities are explained. This export process is same in almost all countries with slight variation. I hope this post helps you in getting a basic training on how to export various products.

In almost all countries, a onetime licensing procedure to act as an Exporter/Importer is required to be completed. In India, IEC number (Import Export Code number) is required to act as an Importer or Exporter.

In almost all countries, a onetime licensing procedure to act as an Exporter/Importer is required to be completed. In India, IEC number (Import Export Code number) is required to act as an Importer or Exporter.If you are an exporter, you would have already set up an Export company by following necessary government rules and regulations. By choosing your export product, you would have sent export samples to your international buyer if required and got approved. After necessary communication with your overseas buyer on terms of payment and terms of delivery, you arrange to issue proforma invoice, in turn you receive export order followed by purchase order from your overseas buyer. The terms of payment for your export contract could be advance payment, Documents against Acceptance DA, Documents against Payments DAP, or under Letter of Credit LC. If you as overseas seller require to cover credit risk against your overseas buyer, you can approach concerned authorities to cover insurance. In India, ECGC is the authorized agency who covers such credit risks for Indian exporters. Being an exporter, you will have an idea about other risks involved in export. The terms of delivery could be EX-Works, FOB, CFR, CIF, DAP, DDP or any other Inco terms. If you would like to arrange finance against export , you can approach your bank for preshipmentor post shipment finance against export orders obtained by you.

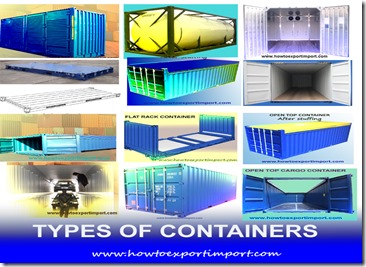

If any international quality check agencies like SGS,BVQI etc. are involved as per the terms and conditions between you and your overseas buyer, such inspection is arranged. After completing necessary quality check (QC) formalities, the goods for export are arranged for proper packing to meet export quality. Palletization or Crating is arranged for safety of cargo. If your export goods are shipped by sea mode of transport, you decide whether the export shipment is by LCL or FCL. Necessary information about shipping of LCL may be collected if sent as LCL. Type of container is decided based on your nature of export goods.

Ok, now the shipment is ready for export. The documentation department prepares export invoice, export packing list etc. based on the purchased order or LC. Application for certificate of origin(GSP – Generalized System of Preference) and other required documents required for importer are also prepared. Necessary documents required for export customs clearance purpose are forwarded to Customs broker. The export process at customs completes either by customs broker or your representative directly. You as an exporter decide whether your export shipment is FCL or LCL. Pre shipment inspections like Phyto sanitary, Fumigation etc. if required have to be completed before export of goods.

Bill of Lading or AWB is issued by carrier of goods. If consolidator involved, HAWB or HBL is issued accordingly. If On Board Bill of Lading required as per buyer’s requirement, you have to wait to get the export shipment go ‘onboard’ the vessel. If you export your goods from a dry port, you have to wait till the cargo to go onboard the vessel, if you need On board bill of lading from shipping carrier.

After completion of export customs clearance procedures and collection of AWB or Bill of Lading, necessary documents for bank and overseas buyer are prepared. The export bill can be disounted, arrange for collection of payment if on credit basis or negotiated if export shipment is on Letter of Credit basis. If you have availed packing credit from bank, the amount of discounted/negotiatedexport bill amount will be adjusted once bank receives export proceeds from your overseas buyer. If bank does not receive such export proceeds from your overseas buyer, your bank may crystalize such export bills, you/bank can approach credit insurance company (like ECGC in India) for claim, if such cover done by you or your bank.